About the market

The securities market

— a part of the financial market that includes operations for buying and selling, as well as issuing securities. It accumulates the movement of finances of citizens and businesses, organizations, as well as the country itself, and directs the results obtained to the development of leading economic sectors.

A security

— is a document that certifies a person's property right. It is exercised or transferred only upon presentation of this document. The main requirement for securities, under which these manipulations will have legal force, is compliance with the appropriate form and the presence of the necessary requisites.

Accordingly, the securities market is a set of economic relations regarding the issuance and circulation of securities between market participants.

The most popular types of securities in most countries include:

An option

— one of the most complex financial instruments traded on the stock exchange. An option is a contract where the subject of trade is not the asset itself, but the right to its preferential sale or purchase. The essence of an option is the ability to buy or sell the underlying asset at the prices you choose.

Forwards

— a purchase or sale agreement made today that fixes all significant conditions, but settlement for the transaction occurs in the future. The forward is obligatory for both parties to execute.

A swap contract

— an agreement between two parties to exchange certain cash flows at specified future dates. A swap can be thought of as a chain of several forward contracts. In simpler terms, a swap is a temporary exchange of any assets.

A futures contract

— a derivative security, which means it is a contract between a buyer and a seller for the delivery of an underlying asset in the future at a price determined at the time of the contract's execution.

A bond

— also a debt security that gives its owner the right to receive a pre-determined income at agreed-upon intervals. When purchasing a bond during its initial offering, the investor essentially loans money to a company (municipality or government) at an agreed-upon interest rate. The next buyer of the bond purchases the debt along with the right to receive the income.

ETF

— exchange-traded investment funds that invest in assets and issue securities under them. ETFs are like a "basket of securities," which means they are an investment fund that trades like a single security, such as a stock. The growth in the value of the securities held in the ETF indicates its success and prospects. The funds themselves can invest in stocks, bonds, and other exchange-traded assets.

Stocks

– securities that provide their owner with a share in the capital of a company. By purchasing shares, you acquire a part of the company.

The term

«cryptocurrency»

is formed from two words: cryptography and currency, meaning a secure electronic currency based on the principles of encryption using mathematical algorithms. Cryptocurrencies are virtual money that do not have physical representation. The key feature of cryptocurrencies is the absence of any internal or external administrator.

The interest rate

— the amount, expressed as a percentage of the loan amount, that the bank receives as compensation for lending funds to the borrower.

Indices

— indicators of the development of both the economy as a whole and individual industries. The very first stock index is the Dow Jones index, a convenient financial instrument that has been in operation since 1884.

Commodity goods

— physical goods that can be exchanged for other physical goods or cash. These are commercially marketable products that you can buy. The financial world divides commodities into two main categories: hard and soft.

Characteristics of a security

When discussing the economic nature of securities, it is necessary to determine several of their essential characteristics, such as:

-

Liquidity,i.e. the ability to be monetized. It is the ability to quickly sell a security at market value. The higher the liquidity of a security, the faster it can be sold, and vice versa: the lower the liquidity, the more difficult it is to sell.

-

Yield or profitability.The main component for those who intend to purchase securities and become a full-fledged participant in the market. The attractiveness of the security for the buyer determines its further movement and possible growth in price.

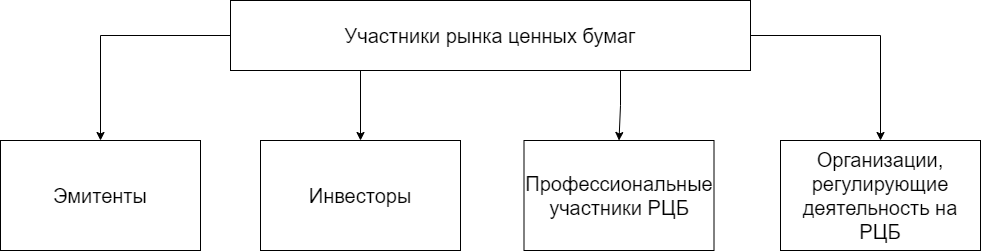

Market participants who have the right to buy or sell securities can be:

-

Issuers.These are legal entities or organizations that issue securities for circulation. Their main task is to attract investments.

-

Depository.These participants are responsible for the safekeeping and accounting of securities. A contract is concluded between the parties involved, which specifies the rights and obligations, as well as the responsibility and subject matter of the transaction.

-

Investors.This is the main component of the financial market in any country. Without this group of participants, it is difficult to imagine the usefulness of the securities market and their further movement. Investors purchase and sell securities, ensuring their continuous circulation in the market. These can be private individuals, companies, governments, and enterprises.

-

Dealers.These are intermediaries who can conduct buy and sell transactions on their own behalf and at their own expense.

-

Managers.This group consists of members

-

Market infrastructure organizations.This includes clearing companies that provide settlement services for transactions.

The main feature of the securities market is its universality and the fact that it allows its participants to trade and attract investments not only at the national, but most importantly, at the international level. This is one of the important platforms that allows countries to share and borrow systems for forming a stock exchange, stock market and similar segments, capable of determining the direction and economic growth of the whole country in the future. Therefore, without the securities market, the functioning of international integration associations (international corporations, conglomerates, etc.) is already impossible. The modern world is largely built on the relationships of political, cultural, and financial spheres.

The presence of a universal, well-developed securities market system in a country allows it to claim itself on an equal footing in the international financial market, provide an opportunity for ordinary citizens of the country to earn an alternative income, as well as significantly increase the revenues of government institutions, attract investments for economic development, and so on. Contrary to the commonly held belief, the stock market is not the main source of funds for investments. However, it is the only legitimate sector that can attract an indefinite number of interested investors.